Financing Your Off-Road Adventure: ATV Loans, Four-Wheeler, and UTV Financing

Imagine the thrill of venturing off-road on a powerful ATV, a nimble four-wheeler, or a versatile UTV, exploring rugged terrains and stunning landscapes. However, turning this adventure into reality often requires a significant financial commitment, which can be challenging for many. Luckily, there are various ways to get the funds you need to make your off-road dreams come true.

You may consider title loans with no inspection on PitriLoans, a trusted financial provider that offers a simple way to get quick and convenient funds. The best part? No need for a complicated inspection process. You can use the value of your existing vehicle to secure the loan.

In this guide, we'll explore traditional options like ATV loans, four-wheeler financing, and UTV loans.

Whether you're a seasoned off-road enthusiast or new to the world of off-roading, we're here to help you make informed decisions about financing your off-road adventure. We'll walk you through the benefits of financing, explain loan terms and interest rates, and guide you through the application process.

Types of Off-Road Vehicle Financing

To help you make an informed decision, let's explore the various off-road vehicle financing options available. From specialized UTV loans tailored to utility task vehicles, to versatile ATV loans designed for all-terrain adventures, and even unique alternatives like no credit check instant cash, we've got a range of solutions to suit different needs.

UTV Loans

If you have your sights set on a rugged and multi-functional utility task vehicle, UTV loans are designed specifically to cater to these off-road beasts. These loans offer competitive interest rates and flexible repayment terms, making it easier for you to bring home your dream UTV and conquer the toughest terrains.

ATV Loans

For those seeking the thrill of conquering various off-road trails on an all-terrain ATV, ATV loans are the go-to option. With favorable loan terms, you can get the financing you need to own the perfect ATV that matches your adventurous spirit.

No Credit Check Loans

Are you concerned about your credit history holding you back from financing your four-wheeler? No credit check instant cash might be the solution you've been looking for. This alternative allows you to access quick funds without undergoing a traditional credit check, making it an ideal choice for those with low credit scores.

Other Financing Alternatives

Apart from the specialized UTV and ATV loans, there are additional financing alternatives worth exploring. These may include personal loans, secured loans, or borrowing against other valuable assets you own. Each option comes with its own set of pros and cons, so it's essential to consider which aligns best with your financial situation and preferences.

Before making any decisions, take the time to compare interest rates, loan terms, and repayment plans to ensure you secure a financing solution that fits both your budget and your off-road aspirations.

Choosing the Right Off-Road Vehicle: ATV, Four-Wheeler, or UTV

When it comes to choosing the perfect off-road vehicle for your adventures, the options can be overwhelming. Among the most popular choices are ATVs, four-wheelers, and UTVs, each offering unique advantages that cater to different off-road enthusiasts. Understanding the characteristics and capabilities of each vehicle type is essential to make an informed decision that aligns with your riding style and preferences.

ATVs (All-Terrain Vehicles)

ATVs, commonly known as four-wheelers or quad bikes, are compact, single-rider vehicles designed to conquer diverse off-road terrains. Their maneuverability and agility make them ideal for navigating narrow trails, tackling rough terrain, and squeezing through tight spaces. ATVs are lightweight, ensuring quick acceleration and responsive handling, providing an adrenaline-pumping experience for riders seeking speed and agility.

Four-Wheelers

Though often used interchangeably with ATVs, four-wheelers can also refer to four-wheel drive vehicles designed primarily for recreational off-road use. They are generally larger and more powerful than traditional ATVs, capable of accommodating one or two riders. Four-wheelers offer increased stability and towing capacity, making them suitable for hauling equipment or engaging in light utility tasks during off-road adventures.

UTVs (Utility Task Vehicles)

UTVs, also known as side-by-sides or utility terrain vehicles, are larger and designed to carry multiple passengers. They are built with a roll cage and offer a comfortable, side-by-side seating arrangement. UTVs excel in utility tasks, making them perfect for work and play off-road activities. They typically come with a cargo bed for hauling gear, making them an excellent choice for camping trips or hauling supplies during your off-road excursions.

Choosing between an ATV, four-wheeler, or UTV largely depends on your intended usage and the terrain you plan to conquer. If you prefer nimble and agile rides for adrenaline-fueled adventures on tight trails, an ATV might be your best fit. For riders who value stability, towing capacity, and the ability to bring a passenger along, a four-wheeler could be an excellent choice. On the other hand, if you need a versatile vehicle for both recreational fun and utility tasks, a UTV might be the perfect match.

Ultimately, it's essential to test ride different models and consider your off-road requirements before making a decision.

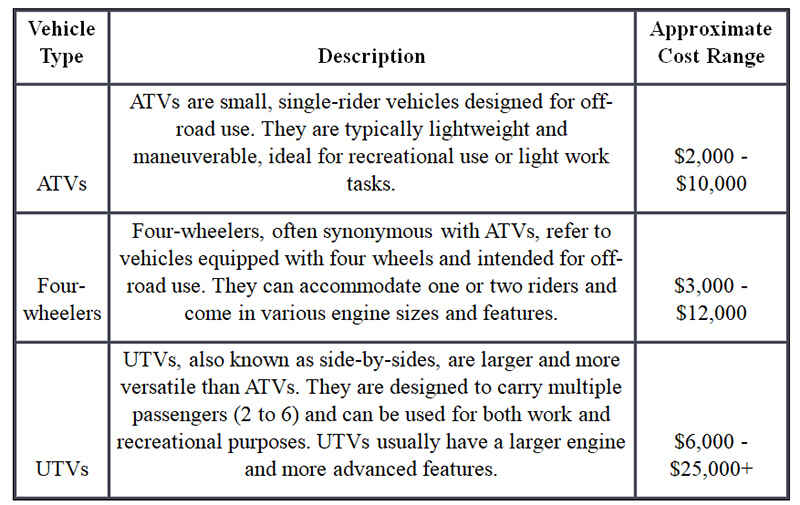

How Much Is It?

Please remember that the prices mentioned above are approximate and based on entry-level models. High-end and more feature-rich models can have significantly higher price tags. Additionally, used vehicles or older models may be available at lower prices.

How ATV Loans, Four-Wheeler, and UTV Loans Work

ATV Loans, Four-Wheeler Loans, and UTV Loans work similarly to other types of auto loans. These loans allow individuals to finance the purchase of their desired off-road vehicles, spread the cost over time, and make manageable monthly payments. Here's how they typically work:

Application Process

To get a loan for an ATV, four-wheeler, or UTV, you'll need to apply for financing with a lender. This can be done through banks, credit unions, online lenders, or specialized powersports financing companies. The application process will involve providing personal and financial information, including your credit history, income, and the details of the vehicle you intend to purchase.

Loan Approval

The lender will evaluate your application, credit score, and financial situation to determine if you qualify for the loan. A higher credit score usually improves your chances of approval and may lead to better loan terms (lower interest rates and longer repayment periods).

Down Payment

Some lenders may require a down payment, which is an upfront payment made by the borrower towards the total cost of the vehicle. The down payment reduces the amount you need to borrow and may also impact the interest rate and loan terms.

Loan Amount and Terms

Once approved, the lender will offer you a loan amount and present the loan terms, including the interest rate, loan duration (usually expressed in months), and monthly payment amount. The loan term for ATV, four-wheeler, and UTV loans can range from 24 to 84 months, depending on the lender and the total amount borrowed.

Interest Rates

The interest rate on the loan is the cost of borrowing money from the lender and is expressed as a percentage of the loan amount. The rate you receive will depend on factors such as your credit score, loan term, and the lender's policies. A good credit score can help you secure a lower interest rate.

Repayment

Once you agree to the loan terms, you'll begin making monthly payments. The payments will include both the principal amount borrowed and the interest accrued over time. The goal is to repay the loan in full by the end of the loan term.

Prepayment and Early Payoff

Some lenders allow borrowers to make extra payments or pay off the loan before the scheduled term ends without incurring penalties. This can save you money on interest if you can afford to pay off the loan early.

Improving Your Chances of Approval

Here are some key tips to improve your chances of getting approved for an ATV, four-wheeler, or UTV loan:

1. Check and improve your credit score.

2. Save for a down payment.

3. Maintain a stable source of income.

4. Keep your debt-to-income ratio low.

5. Borrow only what you can afford.

6. Shop around and compare loan offers.

7. Consider a co-signer with good credit.

8. Demonstrate stability in residence and employment.

9. Pay off existing debts if possible.

10. Review and correct any errors in your credit report.

The Benefits of Online Loans from Direct Lenders

1. Convenience: Applying for an online loan allows you to complete the entire process from the comfort of your home. You can access loan applications 24/7, eliminating the need for in-person visits to traditional brick-and-mortar lenders.

2. Faster Processing: Online loan applications are usually processed more quickly than traditional loans. Direct lenders can review your application swiftly and provide faster approvals, enabling you to get behind the wheel of your off-road vehicle sooner.

3. Wide Range of Options: The online lending market offers a variety of direct lenders to choose from. This competition can lead to competitive interest rates and flexible loan terms, giving you more options to find a loan that best fits your financial needs.

4. Privacy and Security: Reputable online lenders use secure platforms to protect your personal and financial information. You can have peace of mind knowing that your data is handled with confidentiality.

Preparing for Off-Road Vehicle Ownership

1. Budgeting for Your Off-Road Adventure

Determine your budget for purchasing the off-road vehicle. Consider not only the initial cost but also additional expenses such as taxes, registration fees, insurance, and potential modifications or accessories you may want to add.

2. Assessing Your Credit Score and Financial Health

If you're planning to finance your off-road vehicle, review your credit score and financial standing. A good credit score can help secure better loan terms and interest rates.

3. Determining the Total Cost of Ownership

Factor in ongoing costs like fuel, maintenance, repairs, and storage when calculating the total cost of owning your off-road vehicle.

4. Researching Off-Road Vehicle Options

Explore different ATV, four-wheeler, and UTV models to find one that matches your needs and preferences. Consider factors such as engine power, size, features, and intended use.

5. Learning Off-Road Riding Skills

If you're new to off-roading, consider taking a safety course or receiving training to learn essential off-road riding skills and techniques.

6. Understanding Local Regulations and Laws

Familiarize yourself with local off-road regulations, including where you can legally ride and any permit requirements.

7. Safety Gear and Equipment

Invest in high-quality safety gear, including helmets, goggles, gloves, and durable off-road attire. Safety should be a top priority whenever you ride.

8. Securing Proper Insurance Coverage

Ensure you have the appropriate insurance coverage for your off-road vehicle, including liability coverage and comprehensive insurance if desired.

9. Planning Storage and Transportation

Determine where you will store your off-road vehicle when not in use and how you will transport it to off-road locations if necessary.

10. Setting Up a Maintenance Schedule

Establish a regular maintenance schedule to keep your off-road vehicle in peak condition. Proper maintenance enhances safety and prolongs the vehicle's life.

11. Joining Off-Road Enthusiast Communities

Engage with off-road enthusiast communities, both online and locally, to gain valuable insights, tips, and recommendations.

For more information on financing or loans for off-road vehicles, you can visit the Consumer Financial Protection Bureau's webpage on auto loans.

Conclusion

In conclusion, off-road vehicle ownership can be an exciting and fulfilling experience, provided you prepare yourself adequately. Researching and selecting the right ATV, four-wheeler, or UTV that suits your needs is crucial, as is setting a realistic budget to cover all associated costs.

Choosing a reputable dealer or considering used options can further enhance your ownership experience. Additionally, getting proper training and understanding local laws and regulations ensures safe and responsible riding.

Prioritizing safety by investing in appropriate gear and joining off-road enthusiast communities can provide valuable insights and foster a sense of camaraderie with fellow riders.

Remember, responsible off-road vehicle ownership involves respecting the environment, following designated trails, and adhering to safety guidelines at all times. By doing so, you can enjoy thrilling off-road adventures while preserving nature and respecting others.

With careful preparation and a commitment to responsible riding, your off-road vehicle ownership experience is bound to be both enjoyable and fulfilling. So, gear up, explore the great outdoors, and embark on memorable off-road journeys!

Image credit: Depositphotos