Is It Time to Purchase a Car? The Price Is Falling

Is it the best time to finally buy an auto? The demand and prices of used cars are lowering at the moment. The fear of rising interest rates and depression has changed this market. The high-interest rate for auto loans has cooled demand, so used car prices began declining. Here is what you need to consider.

Used Car Prices Are Coming Down

Inflation rates are rising these days. Inflation is what causes prices for services and goods to increase. As a result, more Americans feel pressed for funds and need to find additional ways of getting cash for their needs. People often search for moneylion alternatives, as they need extra money and look for the most suitable lending tools.

Thus, the demand for cars is lowering a bit. Used car prices are starting to decrease, which offers a possibility for consumers to make a big-ticket purchase. Of course, these prices haven't lowered to the pre-pandemic levels and won't do that.

Prices have reduced since last year and are down 3.3 percent now, as the consumer price index report states. Does it mean you should rush with the decision to buy a car now? Purchasing a used auto is still tricky, and here is why.

Price Decrease Vary Among Auto Age and Type

The prices of used autos are lowering now, but this decrease depends on the type of car and its age. Used electric autos have experienced a significant drop. The median price of an electric vehicle used to be $75,324 in July but is $54,314 in December.

A decrease in demand for hybrids and EVs coincided with a drop in gas prices. Among different types of vehicles, minivans, and SUVs have experienced the most significant drop this year.

Used minivans are down 8% and cost $24,992 on average, while used SUVs are down 7% and cost $41,468 on average. Besides, used vehicles also vary by age. Eight to thirteen-year-old autos cost $16,601 on average, and those between 4 and 7 years old cost $27,137 on average. The median price of autos between 1 and 3 years old is $38,987, which is down from $42,375 back in July.

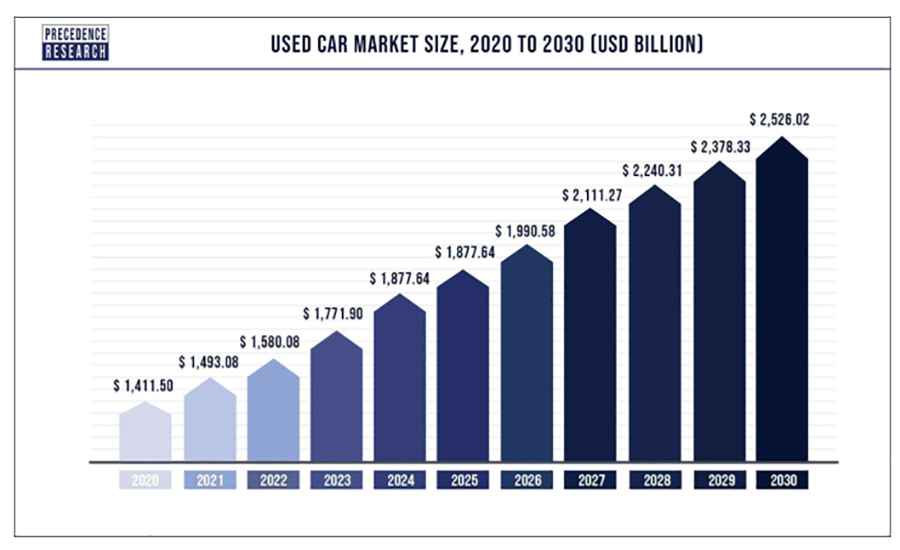

According to Precedence Research, the used car market was valued at US$ 1,411.5 billion in 2020. It is expected to grow at 6% from 2021 to 2030 and is estimated to hit about US$ 2,526.02 billion by 2030. As you can see, the market growth for used autos saw major expansion during the past several years because of the inability of an essential share of customers to purchase a new auto and price competitiveness among new market players.

Top Tips for Buying a Used Auto and Getting a Car Loan

If you don't want to pay much more just to get behind the wheel of a current year's model, you should opt for a used car. The prices of vehicles have been rather high after the global pandemic, and now they have lowered a bit. It may be an excellent opportunity for those willing to make this big-picture purchase.

You will be able to save your finances if you choose a used car instead of an expensive new one. Yet, only some consumers have enough savings to fund this purchase. Lending tools such as personal loans or car loans can be helpful. Here are the best tips to get the best deal.

Shop On the Web

The vehicle market has changed over the past several years, so buying a car on the web has become more popular. Some online platforms allow you to shop for used autos and find great deals. Try Vroom, TrueCar, or Carvana.

Besides, the whole process of buying a car is conducted online, which saves you time. Even if you prefer to have a personal approach and take the conventional route, make sure you do your web research to compare options.

Know your credit score and history

Knowing your credit score and history is a must for anyone looking to take out a loan. It's important to understand that your credit score and history are two separate entities, but they go hand-in-hand in deciding what kind of loan you can expect to get.

A good credit score means the lender is more likely to offer you a loan with lower interest rates, whereas a poor credit score could lead to higher interest rate loans or even rejections. Your credit history - a record of how well you've handled debt over time - also plays an important role as it looks at how reliably you've fulfilled payments in the past.

Conducting regular reviews of both your credit score and history will help protect future financial stability and success down the road.

Shop around for the best interest rates

Shopping around for the best interest rates when taking out a loan is important. Different lenders have different offers, so it's important to compare them and find the one that works best for you.

It's easy to get overwhelmed by the process, so take your time and research your options. Make sure to also check current market interest rates available, as they often make up the basis of any offer presented by a lender. Doing this will ensure you find an offer that works best for you and financially makes sense.

Be prepared to negotiate

Before entering into any negotiation process, it's important to remember that the first offer from the other party might not always be the best. Be ready to negotiate and try to haggle for a better rate based on your standards and needs.

Doing your research ahead of time can be incredibly beneficial - looking up current market prices, researching comparable services in your area, and learning about potential bargaining tactics are all good ways to prepare for successful negotiations.

Asking insightful questions is also key for getting information out of your opponents, allowing you to pinpoint the areas where you stand the greatest chance of making a deal that works well for both of you and allowing you to get the absolute best value possible.

Make a large down payment

Making a large down payment on a financial commitment, such as a car loan or mortgage, can benefit both the short and long term. It reduces your debt quicker by decreasing the principal balance upfront and lets you save more money on interest charges throughout the loan.

Not only that, but it also helps you secure potentially lower monthly payments due to a decreased loan amount. In fact, depending on the size of your down payment and other factors like credit score or loan type, it is possible to reduce your interest rate even further in certain circumstances.

So when planning a major purchase or financing an important responsibility, investing a larger down payment could help on many different levels.

Choose a shorter loan term

Choosing a shorter loan term can be a great way to save on interest payments if you're considering taking out a loan. A longer loan will inevitably cost you more money in the long run due to the added interest, so opting for a shorter repayment period if your financial situation allows it will help you keep more money in your pocket.

Think of the monthly payment amounts over the life of the loan, and make sure that you are able to meet these payments for the duration it is vested out for. Ultimately, shorter loans mean less interest - just remember that this can also mean higher monthly regular payments.

Read the fine print

Understanding the terms and conditions of a loan agreement before signing is an incredibly important step when taking out a loan. It does not matter if you are getting a student loan, car loan, or home mortgage – it is essential that you read through every detail carefully and ask questions if anything feels confusing.

Not paying attention to the fine print could leave you with unintended consequences in the future, so make sure to do your due diligence before signing on the dotted line. Take your time reviewing each aspect of this financial commitment because this is serious and could have long-term ramifications if not paid attention to correctly.

The Bottom Line

To sum up, the prices and demand for used autos are falling these days. It can be the right time to make this big-ticket purchase, provided that you know the pitfalls and follow our tips to make the right choice. Online platforms allow consumers to browse across the country for the right fit and select the most reasonable option.